The first half of this post’s title was a major announcement back in March. Almost exactly nine months after news broke that AT&T would eat up T-Mobile to become a giant force against competitors Verizon Wireless and Sprint, Ma Bell has decided to end its bid to acquire T-Mobile USA. In a press release, AT&T blames the Federal Communications Commission and the Department of Justice for blocking the transaction from happening. Over the past few months, the FCC and the DOJ have been making it difficult for AT&T to buy out T-Mobile. Why you ask? I’ll let competitor Sprint express their viewpoint on the matter:

“From the beginning, Sprint has stood with consumers who spoke loudly and clearly that AT&T’s proposed takeover of T-Mobile would create an undeniable duopoly that would have resulted in higher prices, less innovation and fewer choices for the American consumer.”

In other words, with T-Mobile gone consumers would have a limited selection choosing a wireless carrier and this would impede competition and lead to lower expectations when it comes to innovation. AT&T sees things differently:

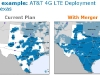

The actions by the Federal Communications Commission and the Department of Justice to block this transaction do not change the realities of the U.S. wireless industry. It is one of the most fiercely competitive industries in the world, with a mounting need for more spectrum that has not diminished and must be addressed immediately. The AT&T and T-Mobile USA combination would have offered an interim solution to this spectrum shortage. In the absence of such steps, customers will be harmed and needed investment will be stifled.

Since Ma Bell wasn’t able to carry through with its acquisition as planned, the company must pay Deutsche Telekom (T-Mobile USA’s German-based parent company) $4 billion before year’s end. Also, AT&T will enter a mutually beneficial roaming agreement with Deutsche Telekom. For more pop after the break to read the PR.

[Via Engadget] Continue reading AT&T to acquire T-Mobile USA for $39 billion …NOT